Estate planning is a task that lends itself to procrastination. However, if you think of it as helping your loved ones in some way, or if you consider it a way to leave a legacy, you may be more motivated. Even if you have few assets and no dependents, there are good reasons to create an estate plan. Without one, your estate can get bogged down in legal conflicts among family members, and the state will decide what happens to your assets.

Your Assets

The first step is to take stock of all your assets. This is about more than just your bank account, car, and home. Be sure to dig into all of your assets, including digital ones. Digital assets include everything from cryptocurrency, to websites you may own, to the photos stored on your computer. In addition, you may have a life insurance policy you purchased when your children were minors. If they are adults now, you may not need it any longer. However, instead of letting it lapse, you might want to look into whether you are eligible to sell it as part of a life settlement. This can feel like a windfall for many seniors who may be unaware they can get cash in exchange for their policy. You can read online how to choose a company. Whatever you decide to do with your insurance policy, write down all of your assets and any relevant information, such as passwords.

The People

Take stock of who is in your family and whom you want to leave things for. For example, suppose you have children from current and former relationships. In that case, you will need to create a plan to ensure all of your children can inherit. In addition, think about whether there is likely to be conflict in your family over your estate plan and whether talking to them about it ahead of time might help.

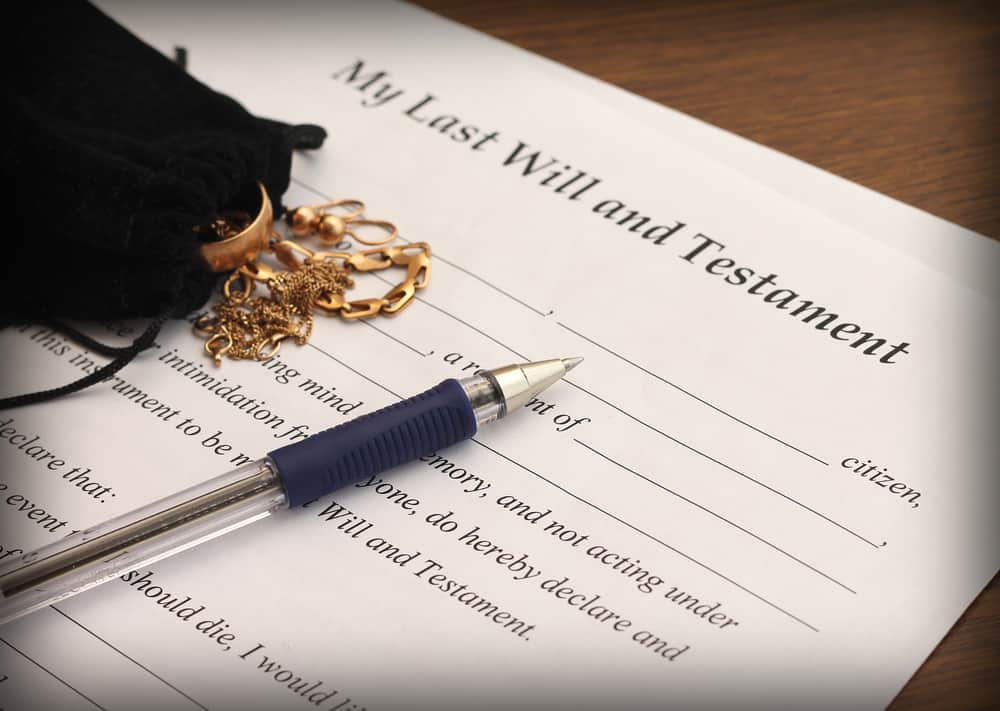

Trusts and Wills

You may only need a will, or you might want one or more trusts. A will is generally cheaper and more straightforward to prepare, but the assets you pass using a will usually have to go through probate. There are a few common reasons wills are contested in court, and the entire process can sometimes take several months or even a year or more. Unlike a will, trusts are private but can be complex and expensive to maintain. However, a trust can be invaluable in many situations, such as if you have a family member with special needs, you want to specify when and how people receive assets, or you want to donate to charity.

Other Documents

Several other documents are a vital part of an estate plan. You may want power of attorney for medical, legal, and financial decision-making. Don’t forget about beneficiary designations, documents that state whom you wish things like your retirement account to go to. It’s common for people to divorce or go through other life changes and forget to update these. However, they should be reviewed regularly along with your entire estate plan.