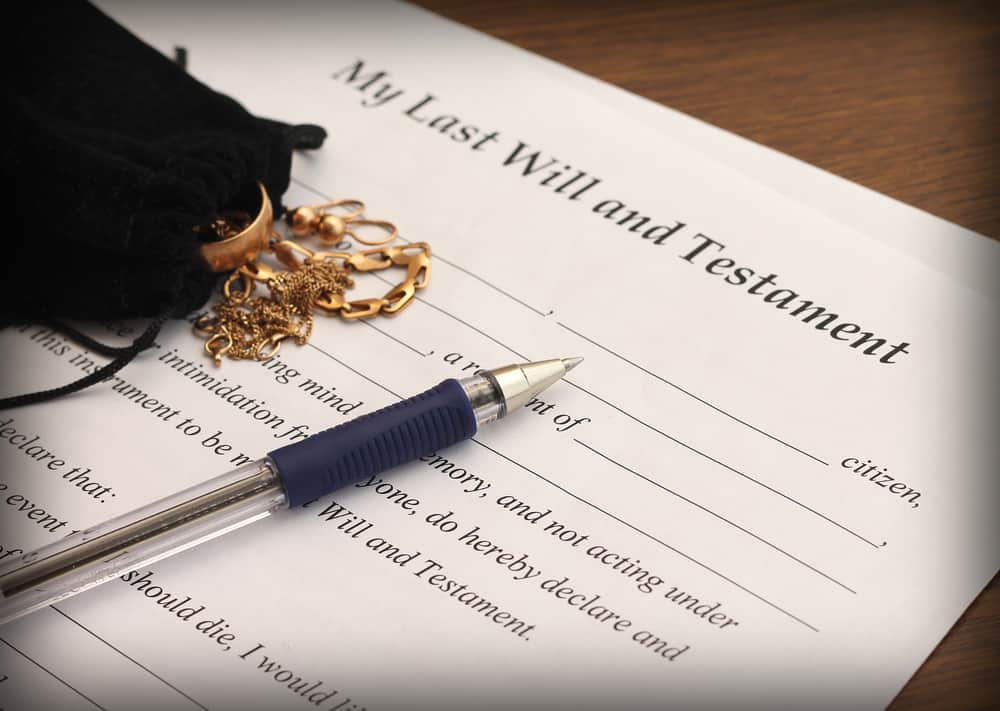

Estate planning can be a daunting and even complex task. However, it is also a necessary task. An estate plan determines who gets what from your assets after you have passed away. Many people, including celebrities such as Aretha Franklin and Prince, die intestate without leaving a legal will. Not having an estate plan leaves your heirs and beneficiaries with the task of settling your affairs at a time when they are also grieving. Though you may not have a massive or complex estate, it is worth creating an estate plan so that your heirs and beneficiaries are not unduly burdened after your death.

Your estate is everything that you own, in other words, your assets. Regardless of how much you own, your assets will have to go somewhere when you die. Saying where they should go and making it easier for your heirs and beneficiaries to receive your assets is the whole estate planning point.

Work With An Attorney and Tax Advisor

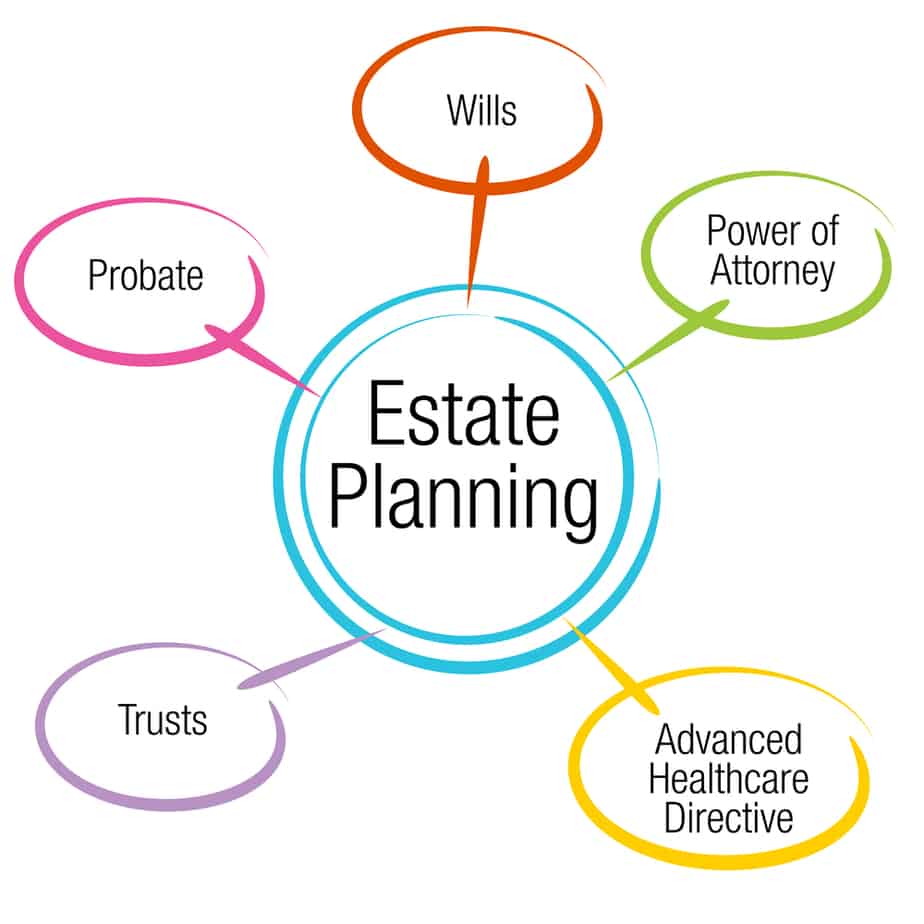

You need to work with an attorney and perhaps even a tax advisor to craft an estate plan suited to your needs. An attorney will guide you through drafting the foundational estate plan documents. These documents include such items as a durable power of attorney, health care proxy, and will. A tax advisor will help you with any tax issues that arise from your estate plan.

Your attorney and tax advisor will help you make the right decisions about the often complex implications of the many choices you will be asked to make. They will also help communicate your wishes, eliminate errors, keep taxes at a minimum and adjust your estate plan as your circumstances and wishes change.

Though they can be pricey, attorneys and tax advisors are necessary elements of the process of creating an estate plan. So, if you’re looking for the best attorneys and tax advisors for your situation, consider their years of experience, reputation, skills, and fee structure. For example, it’s best to choose someone who has excellent expertise in estate planning and tax issues to increase your chances of getting a more favorable outcome.

Maximize Your Estate

This will be a recurring theme of your estate planning. But, again, you need to consult an attorney and tax advisor and determine how you will pass on your assets and estate to your heirs and beneficiaries. The options available will depend on the assets you own, how much they are worth, your age, and other factors.

You need to know your options and the implications of each option so that your estate plan does not bleed court fees, taxes, and other unnecessary expenses.

Generally, the payment of fees and taxes happens when your estate undergoes probate. It refers to a legal proceeding that involves the management and distribution of the decedent’s estate to the heirs and beneficiaries.

However, it’s essential to know that not all estate needs to go through probate. It depends on several factors, including the size of the estate and the estate planning laws of the state where you live. Hence, if you wonder when is probate required in Ontario or wherever you may be, it’s best to contact legal professionals from a full-service law firm for legal advice. They can educate you about probate, the assets included in the said proceedings, and how to avoid it to guarantee a quick and seamless distribution of assets after your death.

Estate, inheritance, and gift taxes

A legal estate plan is, in a big way, the consequence of decisions to minimize taxes. Federal taxes governing estate and gift tax can have outsized material importance in your estate plan. It is also essential to know that many states levy their estate taxes.

Estate and gift taxes typically have exemption limits. This means you can leave your heirs and beneficiaries your assets up to a certain amount without incurring taxes.

It is even possible to transfer your assets in the form of gifts while you are still alive to minimize the tax burden on your heirs and beneficiaries.

Estate and inheritance taxes are calculated from the value of your taxable estate and must be paid before distributing assets.

Conclusion

Estate planning plays an essential role in life. It’s one of the things you should prepare for any uncertainties, including death and incapacity. With an estate plan in place, you can secure your loved one’s financial future. Therefore, if you want to get started with estate planning as soon as possible, keep the information presented above to know what to do to get it done right.