Rent is a significant financial responsibility for many individuals and families, as it is often the largest monthly expense. However, understanding when rent is due can help renters avoid late fees and potential conflicts with landlords. This article discusses the factors determining when rent is due and offers tips for timely payments.

In most cases, rent is due on the first day of each month, as stated in the lease agreement signed by the tenant and the landlord. However, some leases may specify a different due date, such as the first business day of the month or another mutually agreed-upon day. It is essential for tenants to carefully review their lease agreements to determine the exact payment due date.

Aside from the date outlined in the lease, there may be other factors to consider in rent payment deadlines. For instance, certain jurisdictions may have regulations, such as grace periods, providing tenants additional days to pay rent without penalties. Additionally, individual landlords may have their policies, including payment arrangements, upon request. Consequently, understanding one’s particular rent payment situation is crucial to maintaining a successful landlord-tenant relationship.

Understanding Rent Due Dates

Lease Agreements

Regarding rent due dates, the lease agreement is the primary document establishing the terms and conditions between tenants and landlords. In most cases, the lease agreement will specify the date on which rent is due each month, typically the 1st or the 15th. This date should be clearly stated and agreed upon by both parties involved.

The lease agreement may also include information on grace periods and late fees. Grace periods are the time given to tenants to make a payment beyond the due date without penalty. Late fees are the charges tenants incur if they fail to pay by the end of the grace period.

State and Local Laws

In addition to the lease agreement, state and local laws also play a role in determining rent due dates. Each jurisdiction may have its specific rules and regulations governing rental agreements.

For example, some states mandate that rent is due on the 1st of each month, while others allow landlords and tenants to agree on any date within the lease agreement. Furthermore, some states may have grace periods and late fee regulations. Tenants and landlords must know these legal requirements to avoid potential disputes or penalties.

Grace Periods and Late Fees

When it comes to paying rent, both landlords and tenants must be aware of grace periods and late fees. This section will focus on these two critical aspects, with sub-sections covering the calculation of late fees and state-specific regulations.

Calculating Late Fees

Late fees are typically imposed when a tenant fails to pay rent within the designated grace period. These fees are charged to encourage prompt payment and cover any additional costs the landlord may incur due to late payments. Late fees can be calculated in various ways, such as:

- Fixed amount: A predetermined fee is charged for each day the rent is late.

- Percentage: A percentage of the monthly rent charged for each day the rent is late.

The lease agreement must outline the late fee to ensure both parties know the potential consequences of late payments.

State-Specific Regulations

Different states have regulations regarding grace periods and late fees. Here are some examples:

- New York: Landlords cannot charge a late fee unless the rent is more than five days late. The maximum late fee allowed is 5% of the monthly rent or $50, whichever is lower.

- Texas: A landlord can charge a late fee on the first-day rent is late. However, the lease must specify the late fee amount. Texas law limits late fees to a “reasonable estimate” of the additional costs incurred.

- California: California law does not specify a grace period. However, it requires late fees to be “reasonable” and directly related to the financial impact the late payment causes to the landlord.

Tenants and landlords should familiarize themselves with the regulations in their state to avoid potential disputes and ensure they understand their rights and responsibilities regarding grace periods and late fees.

Eviction Process and Prevention

Nonpayment of Rent

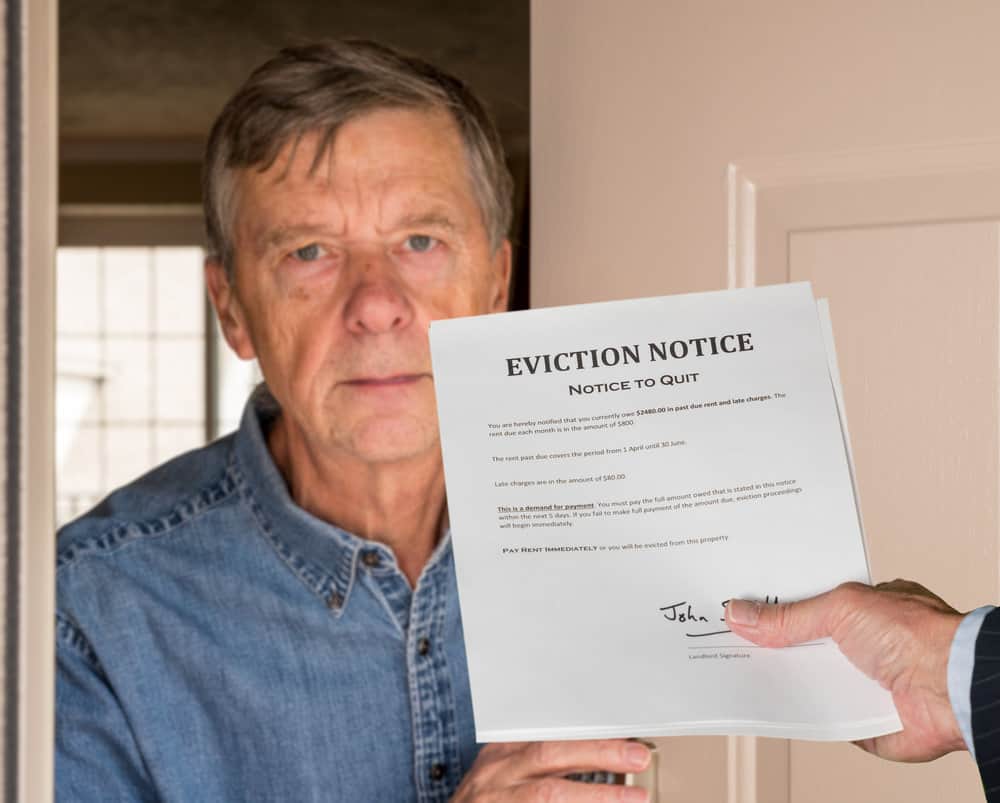

In nonpayment of rent, landlords typically follow a specific eviction process. This process begins with providing the tenant a written termination notice, allowing them to pay the late rent or face eviction proceedings. The time varies by jurisdiction but commonly ranges from a few days to a month. The landlord can file an eviction lawsuit if a tenant does not pay the rent within the specified period.

During court proceedings, tenants have the opportunity to present their defense. Valid reasons for nonpayment, such as repairs not made by the landlord, may result in a judgment favoring the tenant. However, if the landlord wins the case, they obtain a legal order for the tenant’s eviction. Therefore, both parties must familiarize themselves with their rights and local laws.

Payment Methods and Late Rent Issues

Mail and Electronic Payments

Tenants have several options for paying rent, including mail and electronic payments. Mailing a check or money order is common, but tenants should ensure their payment is postmarked by the due date to avoid late rent fees. In recent years, electronic payments have become popular as they offer a faster and more convenient way to transfer funds. This can involve bank transfers, online platforms, or mobile payment apps.

When choosing a payment method, tenants must consider factors such as the rental property’s policies and any additional fees associated with specific options. For example, landlords may impose fees for receiving cash payments, which are generally discouraged due to potential risks and inaccuracies in record-keeping.

Security Deposit Application

At the beginning of a lease, tenants usually provide a security deposit, a safety measure for landlords in case of unpaid rent or property damage during the lease term. In some cases, when a tenant fails to meet the payment date, landlords may have the option to apply the security deposit to cover the late rent. However, this depends on the rental agreement and local laws.

Remember that using a security deposit to cover rent may affect both parties. For example, if the tenant moves out and has caused damage to the property, the landlord might not have enough funds to cover the repair costs. On the other hand, tenants might face difficulties receiving their full security deposit back if it has been used to cover late rent. Both parties must understand their rights and responsibilities regarding security deposits and rent payments.

To avoid potential conflicts:

- Ensure rent is paid on time and in the chosen payment method

- Familiarize yourself with the rental agreement’s terms and conditions

- Communicate with the landlord promptly if payment issues arise

- Maintain records of all rent payments and relevant correspondence

Rental Assistance and Resources

Government Programs

Various government agencies provide rental assistance to those in need. For example, the Treasury Department offered support through its Emergency Rental Assistance program. This program was designed to help households unable to pay rent due to the COVID-19 pandemic. Eligible applicants may receive funds to cover rent, past due rent, and utilities.

Unemployment benefits can also contribute to covering rent expenses. These benefits are designed to provide temporary financial support to individuals who have lost their jobs for reasons beyond their control. To explore eligibility, contact your state’s labor department for further information.

The Census Bureau also collects housing and rental assistance data, which can help policymakers better allocate resources to those in need. For example, the American Community Survey gathers information on rental costs and housing conditions, enabling targeted assistance in areas with the highest need.

Private Assistance

In addition to government programs, private organizations offer rental assistance and resources to individuals facing financial hardship. For example, many homeless shelters collaborate with community agencies to provide temporary housing and refer clients to rent assistance programs.

To diligently address housing problems, exploring available resources and financial assistance provided by various government and private entities is essential. These programs ensure that individuals and families maintain stable housing, shelter, and access to critical utilities.

Responding to Late Rent

Written Notice Requirements

When a tenant’s rent payment is late, it’s essential to follow proper procedures for notifying the tenant. In many states, a written notice is legally required. This typically should include the amount of past-due rent, any late fees incurred, and a clear deadline to pay the outstanding balance. Local laws, such as in Massachusetts, may enforce specific notice requirements and grace periods, which can impact your handling of late rent. Therefore, it is vital to consult with local regulations and to include any relevant terms in the lease agreement or addendum.

Dealing with Illegal Activity

If you believe your tenant is struggling with rent payments due to illegal activity or there is a valid reason, you have the right to take appropriate action as the landlord. Depending on the situation’s specifics, you may need to notify the tenant in writing or involve local law enforcement. Remember that evicting a tenant for illegal activity may be subject to different legal requirements than evicting a tenant for non-payment.

Consider using payment plans or accepting credit cards as alternative payment methods when handling late rent. In addition, offer a rent payment grace period, generally up to five days, giving your tenant some flexibility.

However, take precautions and consult with a legal expert to ensure the correct procedure is followed and to avoid any potential legal disputes. Engage with online resources like Zillow, which has guides about managing late rent situations while protecting the landlord’s legal rights.

FAQs

When is rent typically due?

Rent is usually due on the first day of the month unless the landlord and tenant agree on a different date. Referring to the lease agreement to confirm the exact due date is essential.

Can the rent due date be changed?

Yes, a rent due date can be changed if the landlord and the tenant agree. However, it may require an amendment or addendum to the original lease agreement. Document any change in writing to avoid confusion or disagreements later.

Is there a grace period for paying rent?

Some rental agreements include a grace period, usually 3 to 5 days, during which a tenant can make a late rent payment without facing penalties or fees. However, grace periods are not required by law in all jurisdictions, so it’s essential to read the lease agreement carefully.

What happens if rent is not paid on time?

If a tenant fails to pay rent on time and the lease does not provide a grace period, the landlord may charge a late fee as outlined in the agreement. Additionally, landlords may have the right to issue a “Notice to Pay or Quit,” which demands the tenant to pay past-due rent or move out within a specified time frame.

Can a landlord accept rent payments in various forms?

Yes, landlords may accept rent payments in different forms, such as cash, check, and electronic transfer, as long as it is specified in the lease agreement. Always check with your landlord about the preferred payment method and ensure you comply with the requirements.

It is crucial to familiarize oneself with the rental agreement and local rental laws to clarify any questions about when rent is due and the consequences of late payments. In addition, effective communication with one’s landlord can help resolve uncertainties and maintain a positive rental experience.