Freelancing is challenging for the freelancer four times a year when taxes must be paid on money received or when income is obtained by withholding taxes from one’s salary. New freelancers must educate themselves on their responsibilities and 1099 tax filing perks to ensure they are aware of them and don’t think this just occasionally applies. Every three months, online tax filing is necessary. Here are some suggestions whether you’re trying to decide whether quarterly estimated tax payments are necessary or require help from returning professionals with these difficult tasks.

Submitting Quarterly Tax Returns

If you get paid, your taxes are typically taken care of. If you get a large amount of non-wages income, such as interest, dividends, or money from freelance work, figure out the tax deducted from each quarter’s profits to ensure your taxes are paid for the full year. However, you might face additional fines if your anticipated return is incorrect when you file your taxes at the end of the year. You can also submit quarterly payments if your total anticipated tax bill is at least $1,000 as of April 15th.

In this case, you won’t be punished even if more than 100% of the anticipated payment was made by December 31st. Even if taxpayers owe more than they can pay within the allotted time since their annual withholding plus timely monthly projections equal 90%, they can still be confident that no penalty cost will be assessed. Everyone who requires such protection is covered by this element of a “safe harbor,” not only taxpayers with taxable income.

Independent contractors and self-employed taxpayers must pay the self-employed tax or SECA taxes. Your self-employment income will determine how much.

Taxes are regularly paid

You can submit your quarterly tax returns online using the annualized income installment method by performing the following:

Calculate your estimated tax for an individual or business using Publication 505 and Form 2210. (or the instructions that come with these forms).

Calculate the monthly payment by dividing the total into twelve equal installments over a year (for example, $12,000 divided equally by 12 is $100).

Identify which payment methods are most favorable for you by using IRS publications like Publication 505 as a guide.

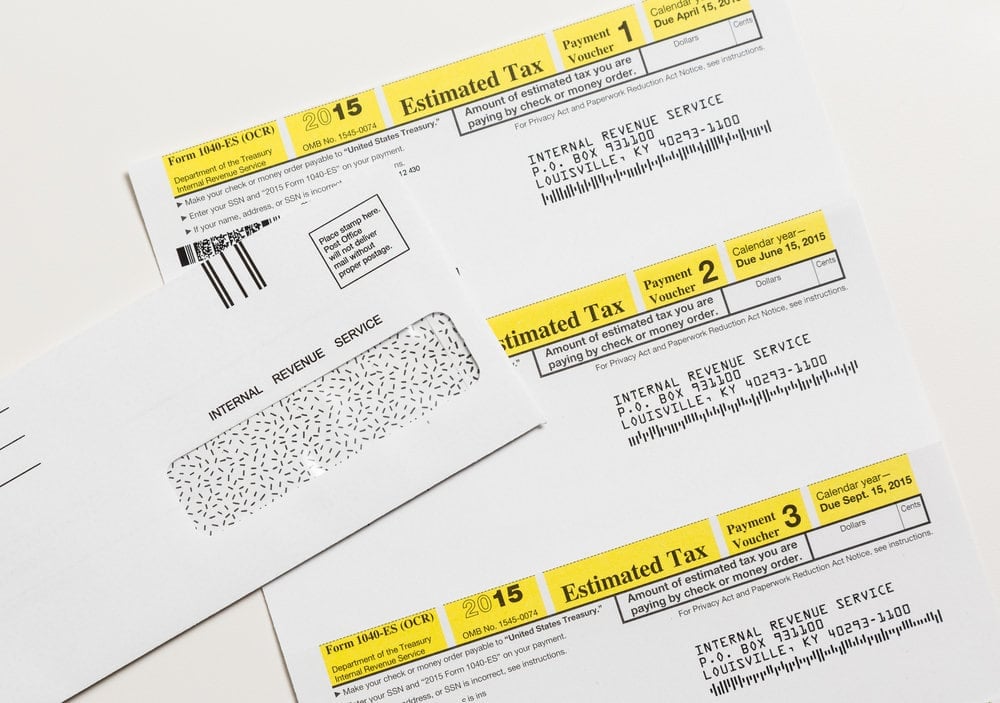

To prevent penalties or interest, double-check your payment. To file your taxes, you must first determine your income and expenses. It is done by completing Form 1040-ES. Checks, cash, money orders, credit card, debit card, and electronic transfers of tax information via the Electronic Federal Tax Payment System are all acceptable forms of payment (EFTPS). You can pay expected taxes in several ways, all of which are covered in the instructions for Form 1040-Estate. To minimize problems brought on by inaccurate information, be careful to explain your living arrangement in writing accurately. If you reside in a neighborhood frequently affected by natural catastrophes and owe more than one sort of expected tax each quarter, please return to this page for more information.

Regular tax filing deadlines

There are intermittent holiday extensions for the due dates for projected tax payments in addition to April 15, June 15, September 15, and January 16 of each year.

Avoiding punishment

You must determine how much tax will be deducted to prevent a penalty. Suppose your anticipated tax payments or withholding equal at least 90% of what is owed in 2022 or your 2021 return shows 110% of the taxes owing (assuming income was more substantial than $150K). In that case, it will be easier to avoid penalties.

What happens if I don’t pay my quarterly obligations?

If you do not pay your taxes all year, you should plan on a sizable tax bill when you file your taxes. You will also be assessed interest penalties and late fees if you fail to pay them by the due dates.

The tax filing deadline is every three months. Acknowledge your duties and try to fulfill them as closely as possible. It may be wise to seek professional help or use an A.I.-powered 1099 tax calculator from FlyFin if your query requires in-depth information to submit quarterly taxes online.