Divorce is decision people commonly make. That does not mean it is easy to make, however. When you have assets and debt held in common with your partner, things can get complicated quickly.

A skilled divorce attorney can help you, but this guide will give you a good start.

Common Causes of Divorce

Most of the time, when people commonly get divorced, they do not anticipate it. People do not get married to get divorced. However, thousands of divorces happen each year.

What are the most common causes of these divorces?

Lack of Communication

Couples report lack of communication is the most significant factor influencing divorce decisions. It would be best if you remained communicative with your partner. No matter how long you are together.

Growing Apart

Some couples report that throughout their marriage, they grow apart. This is more common when people get married young. Young adults grow into many different middle-aged adults a lot of the time.

That is not bad, but it could mean you are incompatible with someone you married when you were young.

Financial Difficulties

Financial difficulties commonly cause excessive stress. Financial stress is one of the leading contributors to divorces as well.

Lowering your monthly bills can help relieve stress and make a divorce less likely. Actively pursuing a course to reduce your monthly expenses can make a huge difference in your family finances and reduce the stressors that may be underlying your issues.

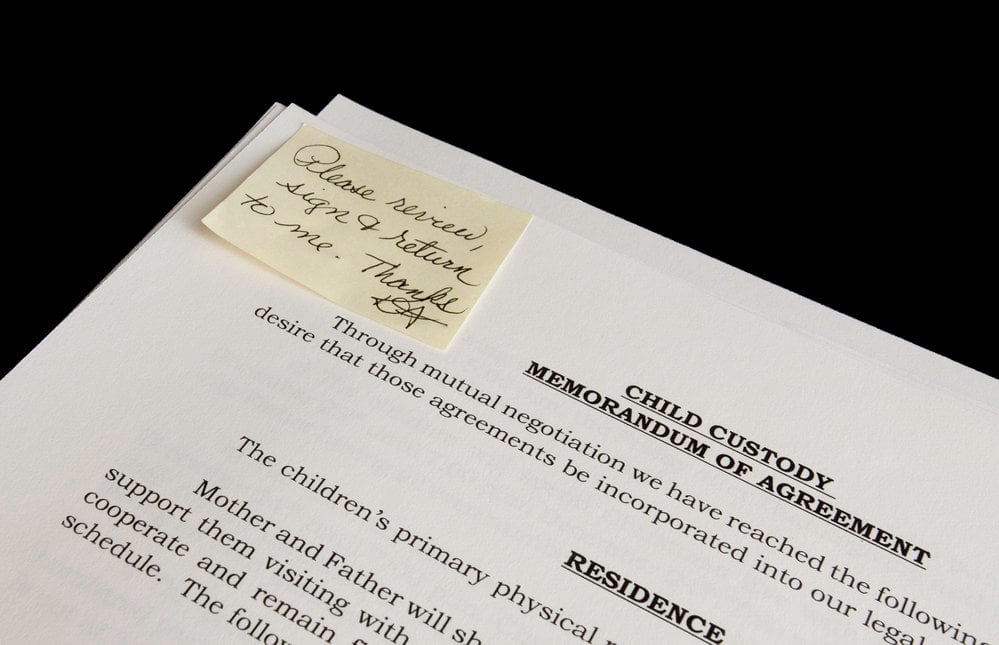

Divorce and Division of Debt

Divorce can quickly get complicated when you have significant debt in common with your spouse. Most states do not have specific rules that split 50-50 between partners.

For example, in the state of Texas, debt division is determined by the judge. The only requirement is that the debt division is just and proper.

Asset Division

Asset division is another complicated aspect of a divorce. The state will determine the rules of this. We recommend consulting with an attorney if you have assets held in common with your partner and pursue a divorce.

Starting Over Financially After Divorce

Most people that get divorced commonly have to start over financially. This can be daunting, but you will make it through these difficult times by following this advice.

Bankruptcy

Sometimes the amount of debt you are commonly left with after declaring divorce is not maintainable.

However, it would be best if you did not make this decision lightly. When you declare bankruptcy, it can take up to seven years to fall off your credit profile.

Career

Sometimes when you get married to someone, you forgo having a career. This can cause difficulties with your earning ability after divorce. You may have a significant gap in your job history.

You will need to work against the odds to overcome these obstacles. Consider returning to school and expanding your skill set if you have difficulty finding a sustainable career.

Living Within Your Means

Living within your means is the most important thing you can do when you get divorced. Most people that get divorced are accustomed to living in a two-income household. When you get divorced, you must live on a single income.

This can be a difficult transition, but it is a necessary one. Living within your means ensures you do not incur even more debt after the divorce is finalized.

Final Thoughts on Divorce and Debt Division

Divorce is an important life decision people commonly make. That does not mean that it is an easy one or the right one.

We recommend trying to work things out with your spouse if possible. We all have difficulty in our relationships, but clear communication can often overcome this.